Thursday, March 27, 2008

Monday, March 24, 2008

"They are not 'those' kids, they are 'our' kids...."

Especially listen from 28:20 to the end (less than 9 minutes).

Sunday, March 23, 2008

Thursday, March 20, 2008

Inflection Point for Commodities

There are several factors putting pressure on commodities: overbought technicals, short term strengthening dollar, popping of speculative micro-bubble, hedge funds needing to cover margin calls and thus selling anything with gains, weakening of the economy, and relative geopolitical stability. Deflation.

There are several factors putting pressure on commodities: overbought technicals, short term strengthening dollar, popping of speculative micro-bubble, hedge funds needing to cover margin calls and thus selling anything with gains, weakening of the economy, and relative geopolitical stability. Deflation.As outlined in the New York Times, these factors are leading to a drop in gold, silver and oil. And when commodities drop, it is often precipitous. The smart money gets in early and gets out early, and it's time to take profits if you have not already done so.

The booming commodities market has become increasingly attractive to investors, with hard assets like oil and gold perhaps offering a safe hedge against inflation, as well as the double-digit gains that have fast been disappearing from the markets for stocks, bonds and real estate.

Undeterred by the kind of volatile downdrafts that sent oil plunging 4.5 percent Wednesday, to settle at $104.48 a barrel, large funds and rich individual investors have sent a torrent of cash into this arcane market over the last year, toppling records for new money flowing in.

Small investors are plunging in, too, using dozens of new retail commodity funds to participate in markets that by one measure have jumped almost 20 percent in the last six months and doubled in six years.

But this market, despite its glitter, offers risks of its own, including some dangerous weaknesses that are impairing the ability of regulators to police fraud and protect investors. Commodities are also vulnerable to the same worries affecting the rest of Wall Street, where on Wednesday the Dow Jones industrial average plunged almost 300 points, erasing more than two-thirds of Tuesday’s steep gains.

Moreover, the biggest speculators and lenders in the commodities markets are some of the same giant hedge funds, commercial banks and brokerage houses that are caught in the stormy weather of the equity, housing and credit markets.

As in those markets, an evaporation of credit could force some large investors — especially hedge funds speculating with lots of borrowed money — to sell off their holdings, creating price swings that could affect a host of marketplace prices and wipe out small investors in just a few moments of trading.

My take is that the long term case for energy, grain and even gold may be valid, but the dollar should strengthen from its oversold position in the short and intermediate term. Positions that would capitalize on this would be Ultrashort Emerging Markets (EEV) or Ultrashort Oil (DUG).

Technology, especially semiconductors have been forming a nice bottom over the last few weeks, which is usually a sign of accumulation. Early, aggressive buyers could look at Sybase (SY) or Taiwan Semiconductor (TSM) or Applied Materials (AMAT). A more careful approach would be to wait for greater conviction, but tech may lead us out of the bear market. Taiwan ETF (EWT) has a lot of TSM and should be a solid player in the intermediate term.

One play may be to go long EWT and short emerging markets (EEV), and keep dollars on hand for now.

Disclaimer: I'm a simple working stiff who knows less than nothing about finance and economics. My interest in the market is solely for entertainment purposes. In no way should my ranting serve as investment advice in any way. (Unfortunately, the same disclaimer is true for every financial "adviser" I've ever sought out.)

Tuesday, March 18, 2008

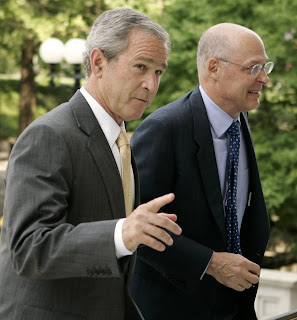

Your President and *His* Money

As usual, The Cunning Realist puts the finest point on the issue, and calls for us to rise up and wield pitchforks. Rage against the machine. The fact is that the federal government prints the money and owns the money and decides how much it is worth in labor and capital goods. It's not our money, and technically it's not real currency anyway since it has no intrinsic value. We are free to accept it as payment for our efforts and salable items, or not. To me, it is becoming clear that the greenback has diminished value and I'm not so sure I want any of it in my savings or retirement accounts since it is quickly becoming junk. Giselle Bundchen, the fashion model, in a recent contract asked for her salary in euros instead of dollars and can you blame her? Stores in New York and other cosmopolitan centers in the US are accepting other currencies as well.

As usual, The Cunning Realist puts the finest point on the issue, and calls for us to rise up and wield pitchforks. Rage against the machine. The fact is that the federal government prints the money and owns the money and decides how much it is worth in labor and capital goods. It's not our money, and technically it's not real currency anyway since it has no intrinsic value. We are free to accept it as payment for our efforts and salable items, or not. To me, it is becoming clear that the greenback has diminished value and I'm not so sure I want any of it in my savings or retirement accounts since it is quickly becoming junk. Giselle Bundchen, the fashion model, in a recent contract asked for her salary in euros instead of dollars and can you blame her? Stores in New York and other cosmopolitan centers in the US are accepting other currencies as well.

I'm not sure if this is a long-term trend or just a passing fad. Trends in the US dollar, however, tend to last several years so this one may have legs. The fact is that the US dollar is currently at the value of 1996, so precedent exists for the current valuation. The ominous issues are the circumstances for the Fed’s willful devaluation, the rapidity of the current trend, and the persistent solvency storm clouds hanging over the banking industry despite all the bullets fired at our currency. The Fed has decided that it will continue to devalue the dollar in order to eliminate debt accrued from duplicitous, cynical, greedy or ignorant individuals and institutions, thus removing moral hazard from our free market ideology. Is this the correct tactic? Maybe, but for those of us who get paid in US dollars and have saved US dollars through personal thrift and sacrifice, it is beyond galling that these hard-earned dollars are now worth 25% less than just two years ago and the reason is the policy of my own government to whom I have faithfully paid taxes and contributed in any way necessary. This same administration who chose to neglect regulation, this same administration who chose to ignore bad mortgages-- what Alan Greenspan called "frothy" a few years ago-- this same administration whose officials come from long careers in business and finance and Wall Street... these same guys are now taking MY paycheck and home equity and bank account and purposefully cutting its value in order to devalue the obscene leverage debt that their pals and colleagues have unscrupulously accrued through obviously craven policies of malfeasance.

This same administration who chose to neglect regulation, this same administration who chose to ignore bad mortgages-- what Alan Greenspan called "frothy" a few years ago-- this same administration whose officials come from long careers in business and finance and Wall Street... these same guys are now taking MY paycheck and home equity and bank account and purposefully cutting its value in order to devalue the obscene leverage debt that their pals and colleagues have unscrupulously accrued through obviously craven policies of malfeasance.

Does it sound like I'm angry? Well, I am. George W. Bush was handed one the greatest opportunities ever given a president of the United States. In 2001, we had a budget surplus, were at peace, enjoyed worldwide diplomatic support and respect, had the largest most advanced military, full employment and an historically strong dollar. We even had a mild recession that gave the president cover to pander to his base of tuxedo-wearers and pass tax cuts for his friends. What Bush did with that hard-earned comity and fiscal health is beyond the pale. He ignored terrorists' warnings; started two wars-- both of which were mismanaged, one of which was immoral; pissed away the budget surplus; made no attempt to re-train workers who lost their jobs to globalization; allowed poor banking and mortgage policies to go unchecked and unregulated… and now to correct all this, he is pissing on my paycheck and assets. A perfect ending to the ultimate economic ass fucking. But I doubt Mr. Bush cares because as The Cunning Realist alludes: Bush is the feudal lord, the United States is his fiefdom and we are the lowly fiefs.

What Bush did with that hard-earned comity and fiscal health is beyond the pale. He ignored terrorists' warnings; started two wars-- both of which were mismanaged, one of which was immoral; pissed away the budget surplus; made no attempt to re-train workers who lost their jobs to globalization; allowed poor banking and mortgage policies to go unchecked and unregulated… and now to correct all this, he is pissing on my paycheck and assets. A perfect ending to the ultimate economic ass fucking. But I doubt Mr. Bush cares because as The Cunning Realist alludes: Bush is the feudal lord, the United States is his fiefdom and we are the lowly fiefs.

Thank you, George W. Bush. (And Uncle Harry and Aunt Nancy aren't much better.) You can have all your lousy worthless dollars… just give me enough to buy one last pitchfork!

Monday, March 17, 2008

Good-bye Greenback

Man oh man, I completely dislike alarmism. I hate it. One of the things I dislike the most about my profession is the overweening drama associated with childbirth. Young parents, emotionally charged, bright lights, high-tech machines beeping in annoying cadence-- all are emblematic of the usually unnecessary and counterproductive alarmism of the modern era.

Man oh man, I completely dislike alarmism. I hate it. One of the things I dislike the most about my profession is the overweening drama associated with childbirth. Young parents, emotionally charged, bright lights, high-tech machines beeping in annoying cadence-- all are emblematic of the usually unnecessary and counterproductive alarmism of the modern era.As the years have passed I have grown used to the omnipresence of dread, whether it's in the delivery room or the financial markets. Almost never are the sum of all fears realized. The Black Swans exist, but we cannot live our lives paralyzed by their prospect.

Few things freak me out as much as the gestalt of realization that our financial markets are vulnerable to any manner of perturbation, and the guys at the helm have been so wrong so many times that confidence is gone. Our fiat currency-- the US dollar-- is dying. Since it is no longer pegged to the gold standard, it floats at the whim of the "full faith and credit of the US government." How much faith do you have in who is running the US government?

We have borrowed from the world in order to finance immoral and unpopular wars, ridiculous consumer spending, imported oil and profligate cronyism. Marc Faber and Jimmy Rogers both think the US dollar is going to zero. Zero! Yeah, I know they are the ultimate alarmists and even broken clocks are correct twice a day, but much of the scenario they have painted over the last ten years is coming true.

My mother was an intelligent, curious and analytic person who learned computer programming in the 1980's. She worked as head systems analyst for a Fortune 500 company until retiring in the early 1990's. She died in 1998. When the US dollar gold standard was halted in the 1970's, she and my grandmother (her mother) argued that the US dollar would die a slow awful death. They bought gold-- as much as they could afford at the time. Those coins are long gone now; investments are now in exchange traded funds (GLD and SLV).

Today, we hear of the US dollar being devalued on a daily basis. The nominal price of gold versus the dollar is at all time highs. Our financial markets are in turmoil and brokerage houses are imploding. If ever there was a time for alarmism, this would be it.

I'm too young to have been immediately affected by the savings and loan crisis in the 1980's. I was cloistered away at a university preparing for my future career and remained completely disaffected, or so I thought. My memory of the time was my mother decrying the cravenness of the power structure (Neil Bush ran Silverado S&L into the ground at taxpayers' expense) and predicting the end of the economic world. It never quite happened.

But the S&L crisis did have an impact on our lifestyles, even if none of us may have realized it. When that much capital goes to money heaven something is indeed lost. Less capital is available for schools and hospitals and business expenses and innovation. Workers put in more hours and effort for the same benefit. We all do suffer a thousand deaths in ways that may not be immediately perceptible.

The same is happening today. Bear Stearns goes bankrupt. The Federal Reserve backs JPMorgan in purchasing the shares at a huge discount and covering the outstanding liability. The market futures continue to decline in a not-so-orderly fashion. To what end? Capital is lost, lending power is lost, faith in the financial markets is lost; less is available for schools and hospitals and business expense and innovation. We all lose.

Don't be alarmed, but be prepared. Hold onto your gold. Buy Swiss Francs (FXF) or Japanese Yen (FXY) on any weakness. Stay away from US Treasuries and stocks. If your financial adviser recommends US stocks today, find another adviser. And if you're a doctor or teacher, don't expect to get a raise any time soon.

Sunday, March 16, 2008

The Black Swan, by Nassim Nicholas Taleb

Nassim Taleb was a financial derivatives trader who made enough money in his 20's (born 1960) and checked out of the rat race to become a "philosopher." His book is a snarky but intellectual appraisal of the pseudo-knowledge employed in our financial markets and elsewhere. He argues that economics is a soft non-science that tries to legitimize itself with "statistical analysis" of risk using techniques such as the bell curve, standard deviation and other charlatanry, which only gives the field a veneer of validity.

Nassim Taleb was a financial derivatives trader who made enough money in his 20's (born 1960) and checked out of the rat race to become a "philosopher." His book is a snarky but intellectual appraisal of the pseudo-knowledge employed in our financial markets and elsewhere. He argues that economics is a soft non-science that tries to legitimize itself with "statistical analysis" of risk using techniques such as the bell curve, standard deviation and other charlatanry, which only gives the field a veneer of validity.

He discusses the Black Swan, i.e. the unlikely event that always rears its head and has profound consequences. The unknowable unknown, the risk which cannot be assessed, is ignored by the managers of risk-- to the detriment of everyone. The book was written a few years ago and the lesson is prescient. Whether its 9-11, the Asian currency crisis of 1998, the Great Depression, the Influenza Epidemic, or the current mortgage solvency meltdown, the markets are always vulnerable to something unseen.

All of the successes in the world, whether it’s Bill Gates’ career or the discovery of penicillin, are reliant on a combination of skill and luck, but luck is always under-emphasized in the human brain. When fortunes are made, the human psyche is quick to take the credit, but when disaster strikes we blame some external phenomenon. Taleb does not call for paralysis in the face of such bias, only truth in assessing the risks and recognition of the lack of control we have. The world is a complicated, interconnected place and one hiccup-- whether man-made or natural-- can spell disaster. It's always the entity that was not anticipated that brings down the house.

Humans are vulnerable to several fallacies and biases that can have deleterious effects on our judgment. The narrative fallacy is the appeal of the story: we look for causation for events and this is often misleading. “The market crashed because x occurred this morning.” David Hume, the great Scottish philosopher outlined the problems with causation a couple centuries ago and we need to re-consider his premise now more than ever.

Another problem Taleb outlines is the Ludic fallacy, the idea that all of life resembles game theory with predictable structure and controllable randomness. In life, however, rules often do not apply and such structure, the idea of which is appealing, is absent.

Taleb discusses various biases to which humans attach themselves. The strongest is confirmation bias that is characterized by seeking “proofs” that our preconceived notions are true. We ignore or avoid information that contradicts our worldview. Coupled with narrative fallacy, confirmation bias can be deadly. While Taleb comes at these topics from a financial point of view, the philosophical constructs are applicable to any field, and I would argue that great understanding is at hand for most scientific fields.

The difference between Platonism--i.e., top-down theorizing ala the Ivory Tower-- versus Empiricism--i.e., experiential real-world knowledge-- is a particularly important part of Taleb’s thesis. We yearn to find science where this is none, whether it’s modern financial portfolio theory or alternative medicine; humans look for the comfort of proof that our preconceptions are valid. Often it’s not there.

The desire to create a narrative to explain history or current events leads to an overvaluation of these usually inaccurate facts. As a result, we overvalue the intellectual elite who proposes the narratives. The debacle of Long Term Capital Management, a group of Nobel Prize winning economists and “experts” who went bankrupt in the 1990’s, is an especially poignant example. The history of medicine is also rife with such false theoretical thinking, with examples of grand theories of bodily humours or gases which needed to be expelled or infused, often with horrific results. Only with the practice of empiric study— reasonable conclusions drawn from our collective experience-- can the truth be found if ever. But we must also know the limits of our empiric knowledge; some things just are not known.

The Black Swan is as important a book as any as we seek bedrock explanations for fast moving events in our globalized existence. Taleb’s points are interesting, his book excellent and my short discussion hardly does it justice.

Friday, March 14, 2008

That's Why They Play the Games

Deservedly unranked and unloved Illinois beat #16 Purdue in round 2 of the Big Ten Tournament in Indianapolis. I didn’t watch the game because it was not televised in our area, (apparently Charter cable thinks West Michigan fans would rather watch the ACC Tournament), but according to the ESPN gamecast it looked like a great win. Come from behind, overtime victory. Who needs Eric Gordon?

Tuesday, March 11, 2008

The Self-Pitiable Obamanauts, Wolcott Edition

First of all, nobody blogging in the English language holds a candle to James Wolcott of Vanity Fair. The fact that he treats us to a near-daily helping of his delicious prose is one of life's gentle hugs, never mind that I care not one lick for half the topics he covers.

First of all, nobody blogging in the English language holds a candle to James Wolcott of Vanity Fair. The fact that he treats us to a near-daily helping of his delicious prose is one of life's gentle hugs, never mind that I care not one lick for half the topics he covers.Most recently, Mr. Wolcott lays waste to the dramatist undercurrent of the self-important Obama supporters. His issue is not with all Obama supporters, mind you, just the ones worshiping the graven images within Obama's cult of personality. Saint Barack of the Transcendent Hope has got himself a loyal posse of Messiah seekers.

Read it yourself-- it is choice.

Sunday, March 09, 2008

Train Wreck!

Ian Welsh at FireDogLake has it right. As he said, his list of economic predictions have been discussed at length over the last few years. We have been watching a slow-motion train wreck ensue right before our eyes, and now the two economic locomotives of cheap oil and ever-increasing home values are just now meeting-- head-on. Ka-boom!

Ian Welsh at FireDogLake has it right. As he said, his list of economic predictions have been discussed at length over the last few years. We have been watching a slow-motion train wreck ensue right before our eyes, and now the two economic locomotives of cheap oil and ever-increasing home values are just now meeting-- head-on. Ka-boom!Ian writes:

1) Housing prices and sales will continue to decline. Expect 3 years before the bottom, as a very optimistic best case scenario.

2) Commerical real-estate will suffer a steep decline as well.

3) Consumer demand will drop. Unemployment will rise.

4) The US will go into a recession at best, a depression at worst. Expect first stagflation (high inflation and high unemployment), both because of the increased price of imports and deliberate pump priming by the Fed, then deflation, as asset prices collapse so hard they take everything else with them. The other likely scenario is stagflation followed by hyperinflation. Formal inflation numbers put out will become not just a joke amongst market-watchers, but amongst the actual population. Same thing with unemployment numbers.

5) The Asian economies are not going to "decouple", they are going to have their own financial crises and recessions. Yes, this includes China.

6) China's stock market will collapse some time next year. China will go into a recession. There will be huge amounts of violence and the Chinese government will redirect anger towards the US and Japan.

7) Multiple banks will probably go insolvent. They are simply holding too much crap paper. There will be an extreme tightening of consumer debt of all kinds, including consumer loans, credit cards and mortgages (this is already beginning, but you ain't seen nothing yet). Even people with good credit will start having difficulty getting loans.

8) Protectionism is going to get stronger. Even if Clinton, a free trader, is put in power, by the time the 2010 Congressional elections are over no "free trade" bill will be able to pass Congress and in fact actual tariffs are likely to be put in place.

From a purely intellectual standpoint, this has been a beautiful portrayal of the way monetary policy can take down the world-wide economy, and I believe we are just at the outset of the calamity. Welsh's list is quite ominous, and hopefully all those predictions won't manifest, but even if just half come about we are in a world of hurt. As he said in the final paragraph, " Hope may not be a plan..." He should have just stopped there. Indeed, hope is not a plan. I'm no economist, but the problem I see is that nobody really has a plan to unwind all this bad debt-- and derivitives and leverage are compounding the negative consequences of all the bad decisions and lack of regulation made over the last 5-7 years.

Most market bulls hang on the meme that the Asian and US economies are "decoupled." That's bullshit. Either we have globalization or we don't; we can't recognize it's insidiousness one day and then claim it doesn't exist the next. If there is a recession or depression, then everyone is going down. Period.

Ian's most ominous prediction is:

9) I wouldn't be surprised, at some point, to see capital controls put in place to stop money-flight from the US.

I'll let you read his six other predictions at the link.

Who knows if any of this comes true, but I'm starting to believe that it might. Marc Faber, the renowned currency trader, recommends that US citizens keep some capital stashed overseas for the possible event of such closures of capital flight. From a timing perspective, the US election cycle is occurring at just the wrong time. Bush, Paulsen and Bernanke are staring at the two locomotives like deer in the headlights, frozen by Bush's lame-duckness and Bernanke's mistaken belief about the role of the federal reserve. For some reason Ben Bernanke seems to think the federal reserve banking system exists to preserve stock market value or something. (The role of the fed is to #1: maintain the value of the US dollar, and #2: maximize employment. Period.) Bush and Paulsen's lack of insight is somewhat understandable and even forgivable in a way when you think about the fact that Bush was re-elected with the voters having all the information available to connect the dots between his utter stupidity and all the problems we face that have been completely avoidable. We get what we deserve.

Bernanke, on the other hand, is an enigma. He is an ivory tower type who supposedly has studied the Great Depression. Hello! Isn't this is exactly what a Great Depression looks like in the early stages! WTF! While most recessions are a simple matter of over-supply and the need for demand to catch up, we currently have over supply (housing) leading to asset deflation, but lowering interest rates has not achieved the desired effect of increasing housing demand. Why? Because inflation in other assets (oil and food) have been grossly underestimated and slowing down the economy-- this is a (lack of ) demand driven recession. Thus, the fed has been enacting a completely wrong policy. As JD at the Big Picture notes, the current subprime crisis is a credit problem, not an interest rate problem. Lowering interest rates in order to "jump start" an ailing economy is a fool's errand. You may get away with it many times, maybe even most times, but when it doesn't work-- like now-- the economy AND the currency both tank together. Recessions in and of themselves are not necessarily bad; as Rick Santelli famously said, a recession is an enema for a bad economy. This should have been done 18 months ago in order to at least preserve the US dollar's value. Instead we have become Bernankeville: weak dollar, high inflation, poor employment and contracting GDP.

Depressions associated with a cratered currency, if that is indeed what we are experiencing, are dangerous things. While some of us may be tempted to high-five each other over our apparent insight in preserving capital by avoiding stocks and riding commodities lo these past several months, economic depressions can explode at any time and in toxic unforeseen ways. Only the lucky survive financially. Our paychecks have become devalued by 20% since 2006, and for many of us our largest assets-- our home and our IRA's-- have likewise been devalued. The indolent chronicity of the current devaluation, as disheartening as it may be, could be abruptly worsened by a sudden snap in the structures of our economy. A rapid rise in unemployment, as Friday's federal employment data has suggested, is not only possible but likely, and the consequences would be grave right now. The world's economies are too entwined to have any safe-havens. If the US consumer loses his or her job and stops buying Chinese toys or Korean computers or Guatemalan clothes, then their economies tank along with ours.

In such a scenario, oil would drop for lack of demand as factories worldwide shut down. Hard commodities like aluminum, silver and platinum would likewise crash due to the halting of end-product manufacture. Gold. Gold may be spared, but who knows? Capital flows to whichever haven is determined to be the safest. Those of us in middle class America may get by with a few less trips to Starbucks or a more austere vacation as our paychecks tumble in value or we collect unemployment, but an increasing majority of the world's population-- an unprecedented number-- depends for their daily survival on the interconnectivity of the world's economies to eat and live safely. Will the fabric of this interwoven economic cloth begin to unravel? Wars, rebellion and pestilence could occur.

Recently my posts about the economy have been depressing. Don't be misled, the worst case scenarios rarely come true and solutions may pop up unannounced (even if I don't happen to see one on the horizon.) The stock market has a way down to go-- who knows it might even crash. Be forewarned, but don't panic. Go to work, do a good job. Invest wisely in gold, foreign bonds and currencies, and US bonds and safe investments. If you have long positions in stocks, then hedge against a market meltdown with Ultrashort ETF's (DXD, SDS, QID or MZZ). Don't buy into the goldilocks fantasy by stock salesman and charlatans. Buy stocks ONLY when there's blood in the streets--and there is nary a drop so far. For a red-alert-save-the-family calamity, open an emergency currency account in Switzerland or at least keep a bag of solid silver dimes under your bed. Why the heck not?

Hang on it's going to be a wild ride!

Monday, March 03, 2008

Preserve Capital

Friends and family reading this, please make every effort to preserve your retirement funds. This is not a time to commit new capital to stocks, especially speculative or high-risk equities. Don't be greedy, be careful.

Friends and family reading this, please make every effort to preserve your retirement funds. This is not a time to commit new capital to stocks, especially speculative or high-risk equities. Don't be greedy, be careful.Government bonds (not munis) and cash are the safest investments now; foreign currencies, gold and silver should be okay. Myriad factors are churning just out of the radar and market risk is very high. I am not being an alarmist, just issuing a strong opinion that severe market fluctuations are a real possibility.

Do not panic. If I am wrong, so be it. I have been easing out of stocks over the last 20 weeks and have been increasing investments in safer asset classes. Now, I am winnowing my holdings in oil stocks as well in preparation for an economic slowdown or recession.

The best appraisal is from Tim Iacona (read the entire article for an excellent review of the current economic reports). Excerpt:

As if the dismal reports on housing, producer prices, and economic growth were not enough, there was even more bad news elsewhere last week. The mood of the American consumer is now quickly souring, the slowdown in manufacturing is accelerating, the labor market is showing increasing signs of trouble, and personal income and spending both disappointed.

Granted, plenty of market strategists and financial planners inexplicably see the current market as oversold and presenting a buying opportunity. I would respectfully disagree. To wit, from Barry Ritholtz:

...consider the following headlines:

Eight Reasons There Won't Be a Recession

Blue chips are signaling recession can be avoided

Stocks in U.S. Tumble After GDP Trails Economists' Forecasts

Eisenbeis Says Concerns of U.S. Recession `Overblown'

U.S. Economy Grew 0.6% in Q4, Less Than Economists Estimated

Despite write-downs, it looks like the bottom is near for stocks

My favorite is "Bush: US not headed into a recession"; Ha! Doesn't that pretty much guarantee it?

Seriously.

Saturday, March 01, 2008

This Nation Needs to Heal (not Heel)

This nation needs to heal. Barack Obama’s message.

Respect is due both Hillary Clinton and John McCain, but the juggernaut of President Obama will not be deterred. The message is clear. Division and triangulation, even under the guise of policy nuance, have no place in the election of 2008.

Fear is everywhere. Fear of recession, fear of inexperience, fear of terror, fear or banking crises, fear that Obama is merely a “cult of personality.” It’s time to put aside the fears and get to work.

I’m not a fan of hope. The Buddha famously said, "Fear and hope chase each other's tail." Oftentimes, a call for hope is either a fatuous rhetorical flourish or a cynical and counterproductive cop-out. It’s not time for hope—it’s time to get back to work to make this nation healthy.

Make a stand. You are either with us or with the terrorists: the terrorists who have instilled fear into a nation. These terrorists have stolen our government, spied on us, waged an illegal war in our names, tortured people and killed civilians with our weapons, transferred wealth to our enemies and willfully devalued our currency. They have damaged our country by destroying our diplomatic relationships, destroying our economy and destroying our spirit.

It’s time to stand up and be counted. We can. Obama is not the movement, but just one member of the movement. It’s about you. This nation needs to heal. This nation needs to re-discover what it’s like to be healthy, to be productive, to contribute.

There's been a lot of damage, so roll up your sleeves.