As usual, The Cunning Realist puts the finest point on the issue, and calls for us to rise up and wield pitchforks. Rage against the machine. The fact is that the federal government prints the money and owns the money and decides how much it is worth in labor and capital goods. It's not our money, and technically it's not real currency anyway since it has no intrinsic value. We are free to accept it as payment for our efforts and salable items, or not. To me, it is becoming clear that the greenback has diminished value and I'm not so sure I want any of it in my savings or retirement accounts since it is quickly becoming junk. Giselle Bundchen, the fashion model, in a recent contract asked for her salary in euros instead of dollars and can you blame her? Stores in New York and other cosmopolitan centers in the US are accepting other currencies as well.

As usual, The Cunning Realist puts the finest point on the issue, and calls for us to rise up and wield pitchforks. Rage against the machine. The fact is that the federal government prints the money and owns the money and decides how much it is worth in labor and capital goods. It's not our money, and technically it's not real currency anyway since it has no intrinsic value. We are free to accept it as payment for our efforts and salable items, or not. To me, it is becoming clear that the greenback has diminished value and I'm not so sure I want any of it in my savings or retirement accounts since it is quickly becoming junk. Giselle Bundchen, the fashion model, in a recent contract asked for her salary in euros instead of dollars and can you blame her? Stores in New York and other cosmopolitan centers in the US are accepting other currencies as well.

I'm not sure if this is a long-term trend or just a passing fad. Trends in the US dollar, however, tend to last several years so this one may have legs. The fact is that the US dollar is currently at the value of 1996, so precedent exists for the current valuation. The ominous issues are the circumstances for the Fed’s willful devaluation, the rapidity of the current trend, and the persistent solvency storm clouds hanging over the banking industry despite all the bullets fired at our currency. The Fed has decided that it will continue to devalue the dollar in order to eliminate debt accrued from duplicitous, cynical, greedy or ignorant individuals and institutions, thus removing moral hazard from our free market ideology. Is this the correct tactic? Maybe, but for those of us who get paid in US dollars and have saved US dollars through personal thrift and sacrifice, it is beyond galling that these hard-earned dollars are now worth 25% less than just two years ago and the reason is the policy of my own government to whom I have faithfully paid taxes and contributed in any way necessary. This same administration who chose to neglect regulation, this same administration who chose to ignore bad mortgages-- what Alan Greenspan called "frothy" a few years ago-- this same administration whose officials come from long careers in business and finance and Wall Street... these same guys are now taking MY paycheck and home equity and bank account and purposefully cutting its value in order to devalue the obscene leverage debt that their pals and colleagues have unscrupulously accrued through obviously craven policies of malfeasance.

This same administration who chose to neglect regulation, this same administration who chose to ignore bad mortgages-- what Alan Greenspan called "frothy" a few years ago-- this same administration whose officials come from long careers in business and finance and Wall Street... these same guys are now taking MY paycheck and home equity and bank account and purposefully cutting its value in order to devalue the obscene leverage debt that their pals and colleagues have unscrupulously accrued through obviously craven policies of malfeasance.

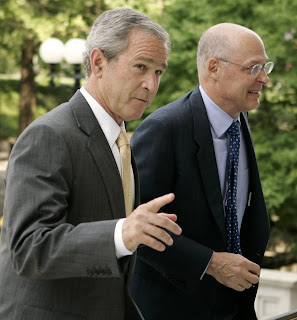

Does it sound like I'm angry? Well, I am. George W. Bush was handed one the greatest opportunities ever given a president of the United States. In 2001, we had a budget surplus, were at peace, enjoyed worldwide diplomatic support and respect, had the largest most advanced military, full employment and an historically strong dollar. We even had a mild recession that gave the president cover to pander to his base of tuxedo-wearers and pass tax cuts for his friends. What Bush did with that hard-earned comity and fiscal health is beyond the pale. He ignored terrorists' warnings; started two wars-- both of which were mismanaged, one of which was immoral; pissed away the budget surplus; made no attempt to re-train workers who lost their jobs to globalization; allowed poor banking and mortgage policies to go unchecked and unregulated… and now to correct all this, he is pissing on my paycheck and assets. A perfect ending to the ultimate economic ass fucking. But I doubt Mr. Bush cares because as The Cunning Realist alludes: Bush is the feudal lord, the United States is his fiefdom and we are the lowly fiefs.

What Bush did with that hard-earned comity and fiscal health is beyond the pale. He ignored terrorists' warnings; started two wars-- both of which were mismanaged, one of which was immoral; pissed away the budget surplus; made no attempt to re-train workers who lost their jobs to globalization; allowed poor banking and mortgage policies to go unchecked and unregulated… and now to correct all this, he is pissing on my paycheck and assets. A perfect ending to the ultimate economic ass fucking. But I doubt Mr. Bush cares because as The Cunning Realist alludes: Bush is the feudal lord, the United States is his fiefdom and we are the lowly fiefs.

Thank you, George W. Bush. (And Uncle Harry and Aunt Nancy aren't much better.) You can have all your lousy worthless dollars… just give me enough to buy one last pitchfork!

1 comment:

Well, you and I understand this. But the average Joe six-pack voter needs to be edumacated in stark, crystalline, irrefutable terms. In addition, we as an all-encompassing society (with all the systems biology/GAIA/network concepts that surround it) need (1) a truly ethical and far-sighted fiscal policy and capable people to execute it, and (2) the same in our elected political leadership, where they know that they truly serve at the pleasure of the electorate. That won't happen until we have (A) rigorous campaign finance reform, and (B) income tax reform that penalizes the kinds of Wall Street excesses that are currently being enabled and forgiven by our fiscal policy and political leadership, and that truly supports the growth of the middle class (yes - A and B have a significant chicken-and-the-egg relationship).

Post a Comment